Stochastic Trading Signals

Pinpoint Entry Reversals

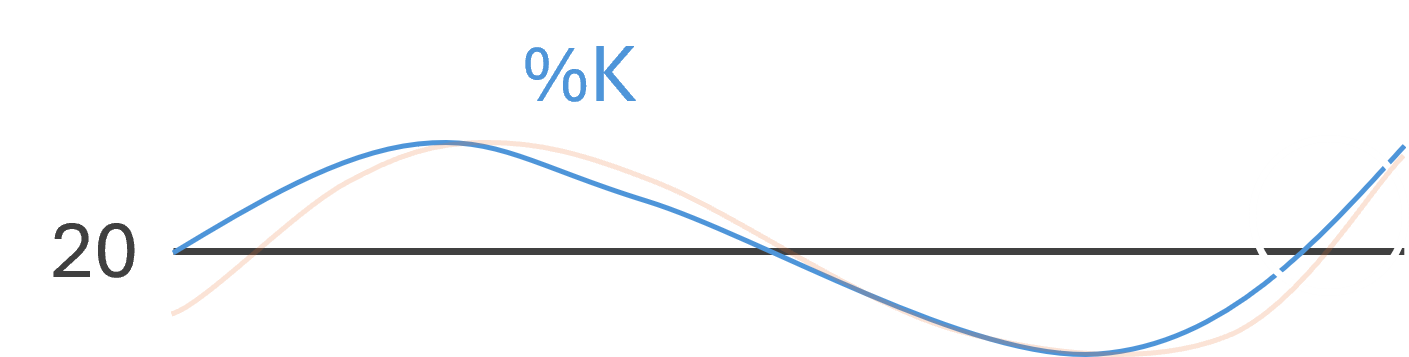

Stochastic Crossing 20 Line Upwards

This signal occurs when the %K line of the Stochastic oscillator crosses upward through the 20 level, indicating that an oversold condition may be ending and bullish momentum could be emerging. The Stochastic oscillator is calculated by comparing the current closing price of an asset to its price range over a predetermined period—typically 14 periods—and it consists of two lines: the fast-moving %K line and the slower-moving %D line. When the %K line is below 20, the market is generally considered oversold, which suggests that selling pressure has been intense.

An upward cross of the 20 threshold by the %K line signals that the oversold conditions might be reversing, implying that buyers could be stepping in. This initial move above 20 by the %K line often serves as an early indication of a potential bullish reversal.