Moving Average Trading Signals

Confirming Uptrend and Market Momentum

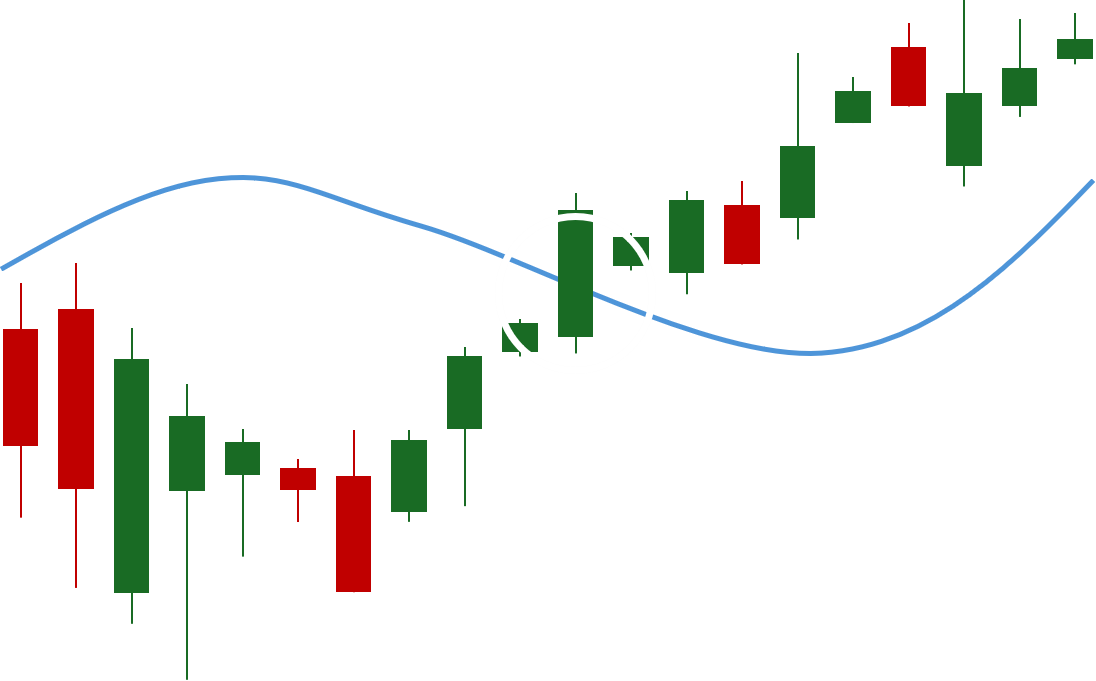

Moving Average Crossover

This signal occurs when the asset’s closing price moves from below to above its moving average, indicating a potential bullish shift in market sentiment. The moving average can be calculated using various methods, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA), and can be set to different periods (e.g., 10, 20, etc.) depending on the trader’s strategy. The crossover signifies that recent prices have gained momentum and are now trending upward relative to the historical average. When the price crosses above the moving average, it may signal that the current trend is strengthening, potentially marking the beginning of an uptrend.

The flexibility in choosing the type of moving average and its period allows for adaptation to various market conditions and trading styles. For instance, a short-term moving average might provide earlier but potentially less reliable signals, while a longer-term moving average might yield more stable, albeit delayed, signals. Adjustments to these settings can help filter out market noise and improve the reliability of the signal. Ultimately, a moving average crossover where the closing price moves above the chosen moving average is viewed as a bullish cue, suggesting that buyers are beginning to assert control over the market.